01.

Les enjeux

02.

Solution

Décisionnel

Supervision

Expérience

Quelques Applications

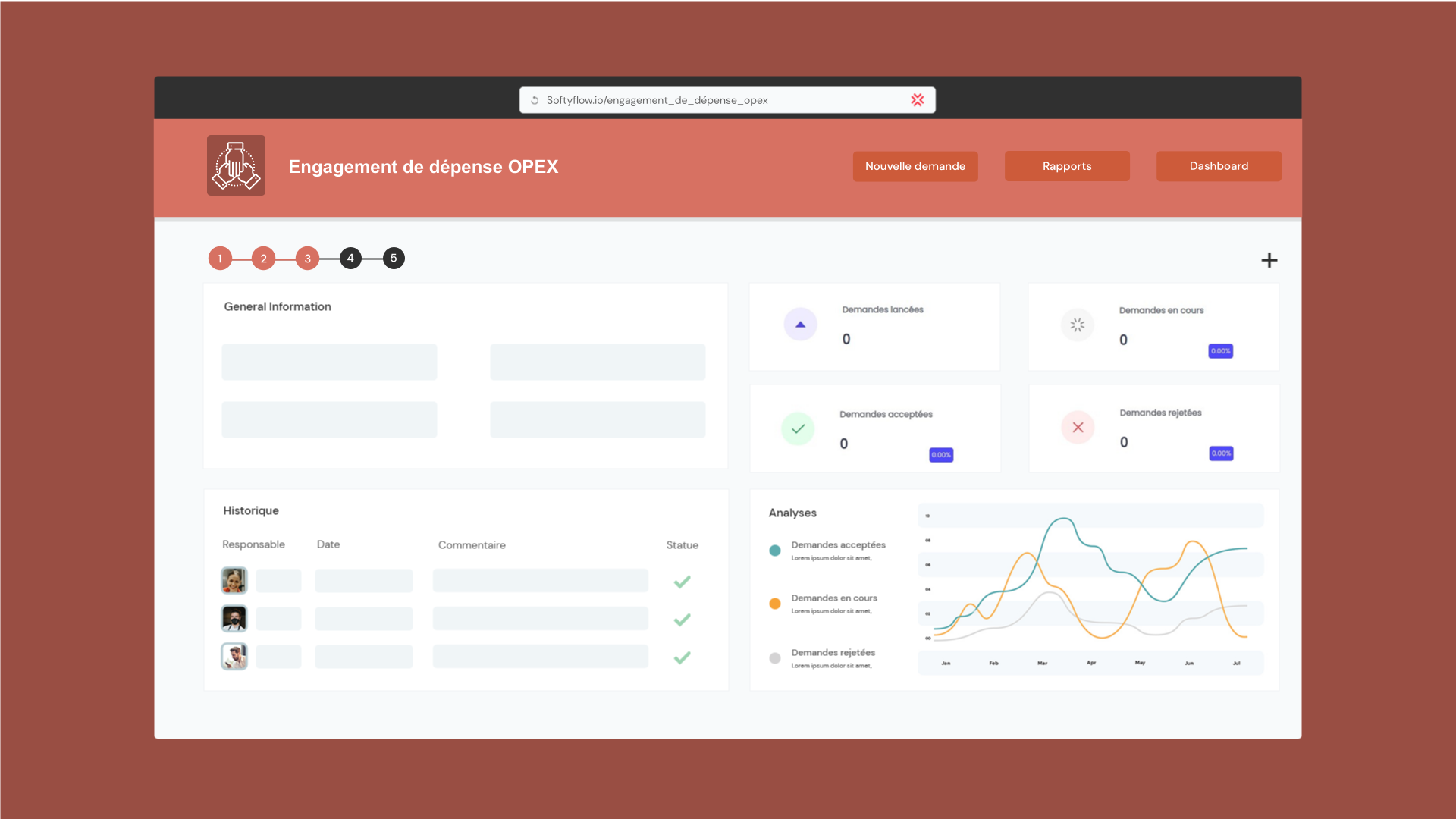

Gestion des paiements et des dépenses

Rationalisez les rapports de dépenses avec des rapports digitaux pré-remplis, des notifications automatiques et des approbations faciles. Les processus sans papier consolident les processus de paie, collectent les reçus et éliminent les retards.

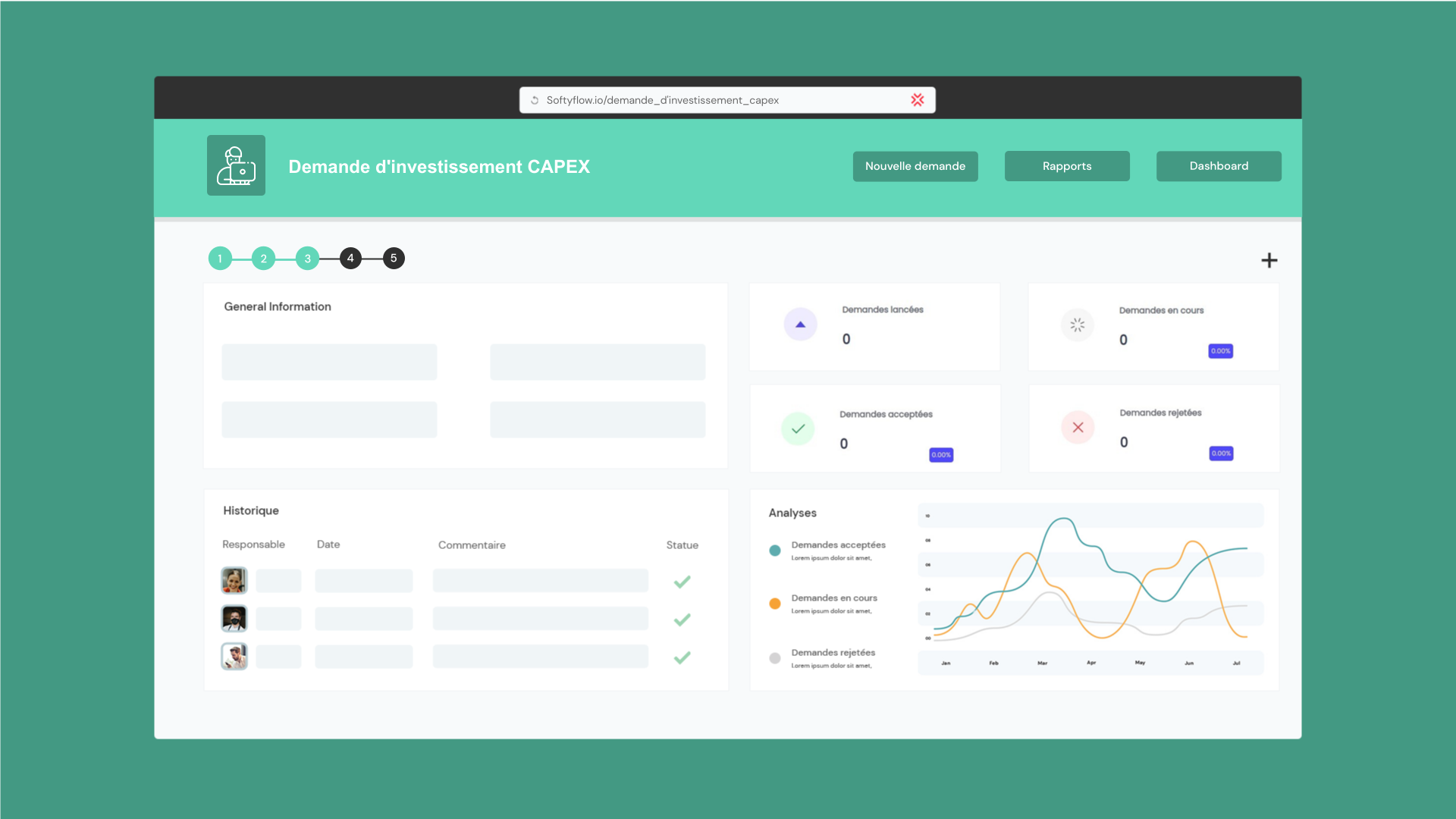

Demande d'investissement

Automatisez les demandes d'investissements. Chaque processus comprend une piste d'audit complète des approbations financières et des commentaires, assurant la conformité de votre organisation sans travail administratif supplémentaire.

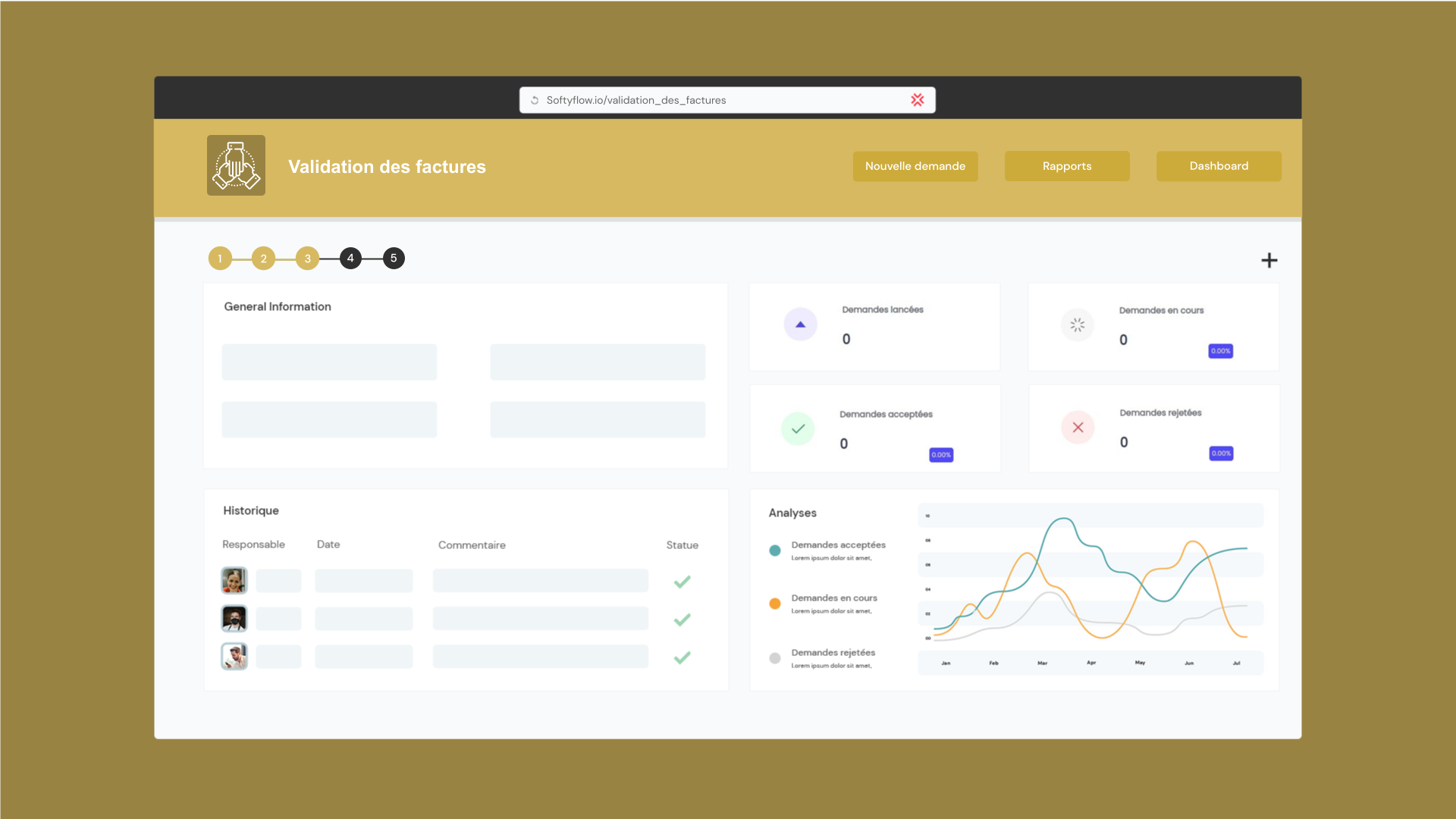

Dématérialisation des factures

Dématérialisez et automatisez le traitement de vos factures afin de gagner en productivité et améliorer la traçabilité de vos flux financiers. De plus en plus déployé dans les entreprises, ce mode de gestion digital des documents comptables améliore les performance.

Gestion du recouvrement

Améliorez votre trésorerie et réduisez les délais de paiement grâce à des processus de recouvrement automatisés. Générez des lettres de recouvrement et des listes de comptes en souffrance et ainsi automatiser vos relances. Génération automatique de rapport pour faciliter la supervision.